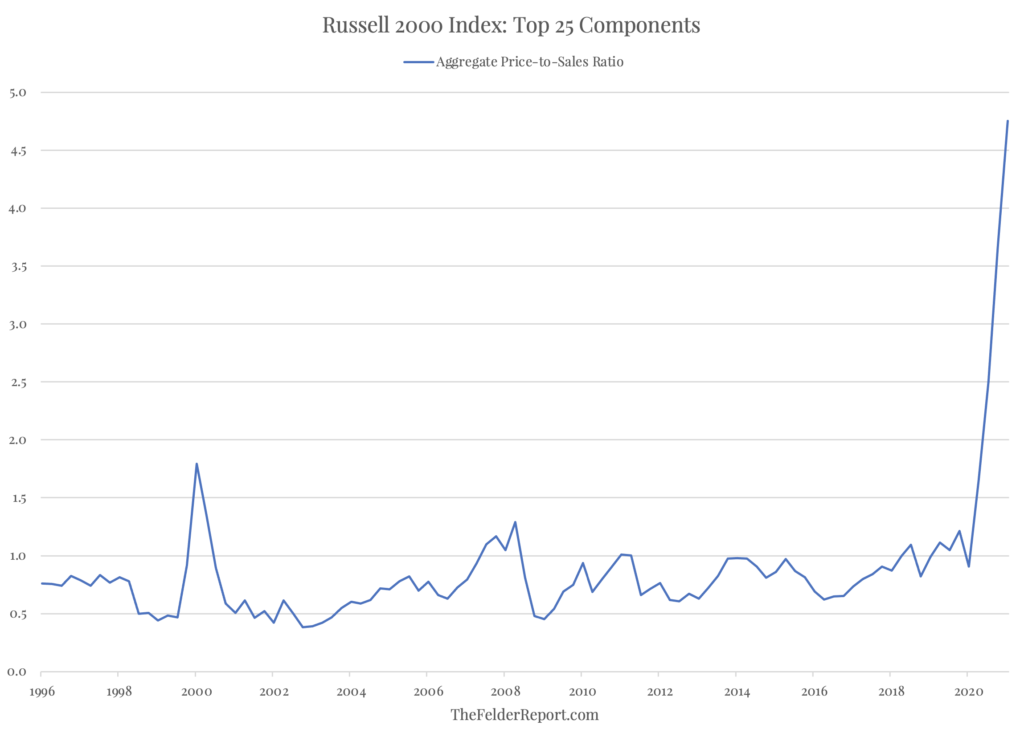

Small cap stocks have had an incredible run over the past year. The Russell 2000 Index has more than doubled from its March lows and is now nearly 40% above its pre-pandemic highs. It has stocks like GameStop and Plug Power, its two largest components which have both soared more than 1,000% over the past year, to thank for this. In the case of these two, the valuations have famously soared to truly unbelievable heights. But this phenomenon is not an isolated one. In fact, when looking at the the top 25 components of the index, the average price-to-sales ratio has risen 400% since the start of 2020. In aggregate, the valuation of the group is now absolutely mind-blowing.

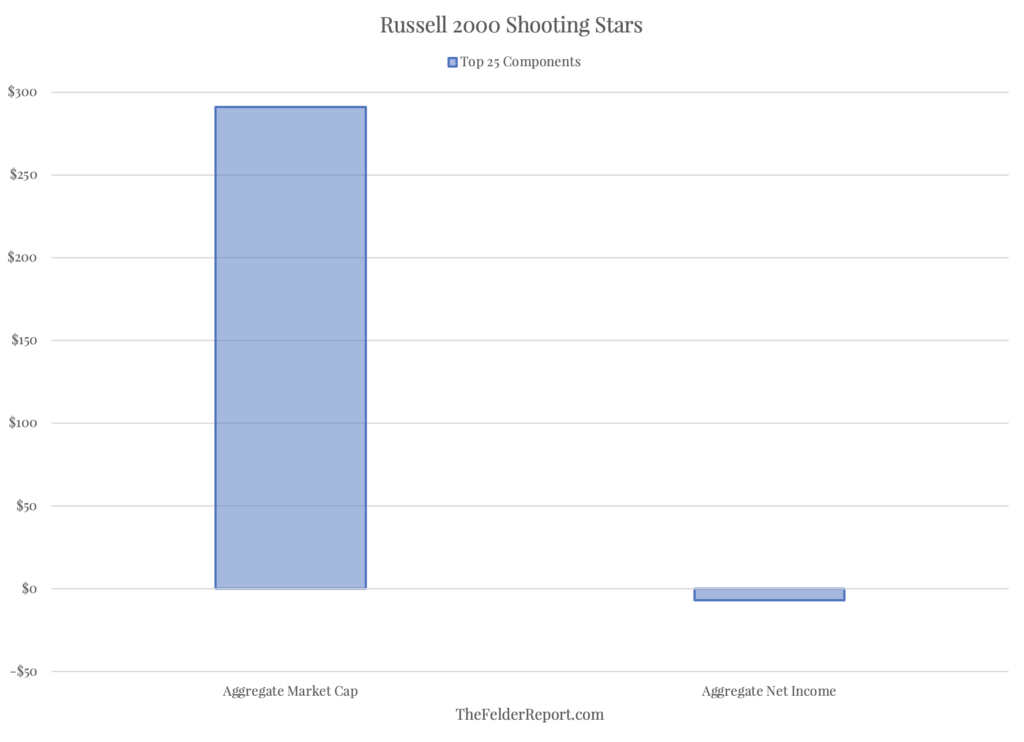

We’ve just never seen anything like this ever before. What’s more, the aggregate net income of these 25 high flyers over the past 12 months is a negative $6.8 billion. For the privilege of acquiring an ownership stake in this negative cash flow stream, small cap investors are now paying nearly $300 billion. (And before you counter that income has fallen due to the pandemic, know that aggregate earnings for this group was negative even before the pandemic began.)

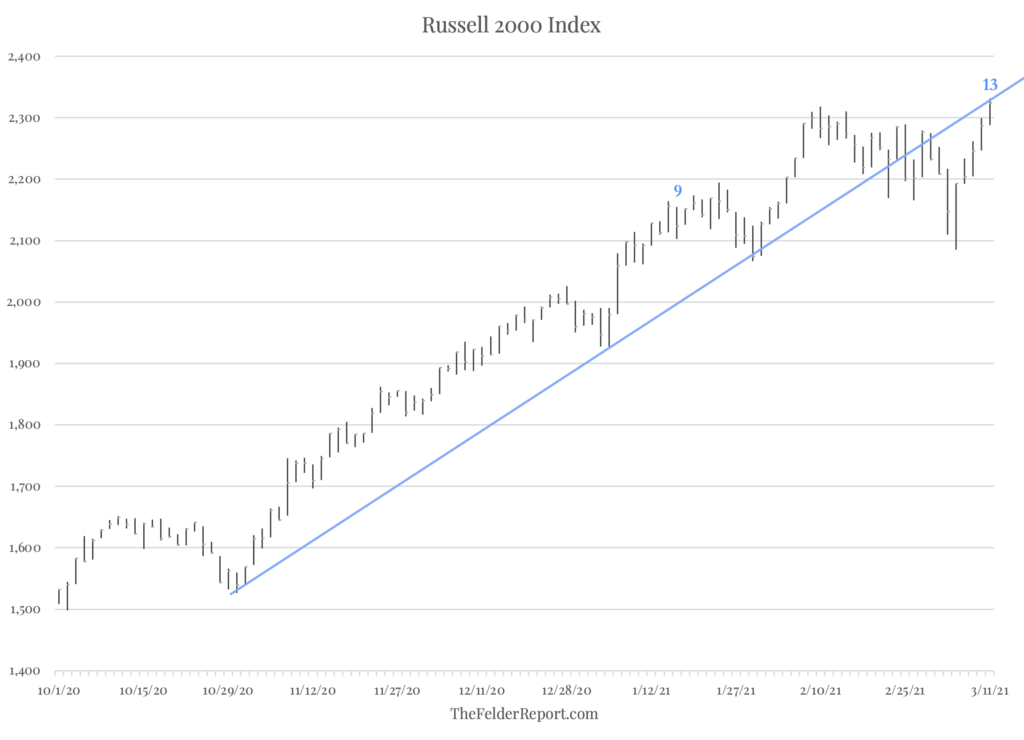

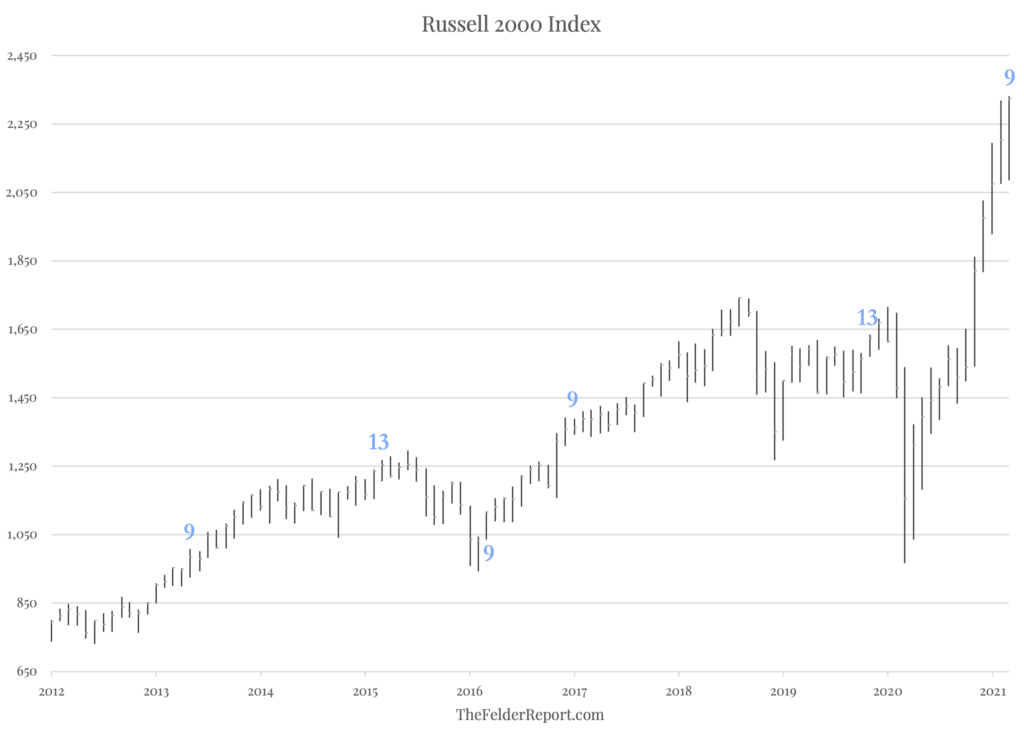

However, there are now a cluster of signals suggesting this incredible blow off in small cap stocks could be close to exhaustion. On a daily time frame, today marks the triggering of a DeMark Sequential sell signal just as the index tests the underside of its broken uptrend line (and its February high).

Breadth is also possibly in the process of creating a bearish divergence with prices, similar to that seen just prior to the Covid crash.

In addition, a weekly DeMark Sequential sell signal will trigger on Monday (not pictured) and this month marks the completion of a monthly DeMark Sequential 9-13-9 sell signal.

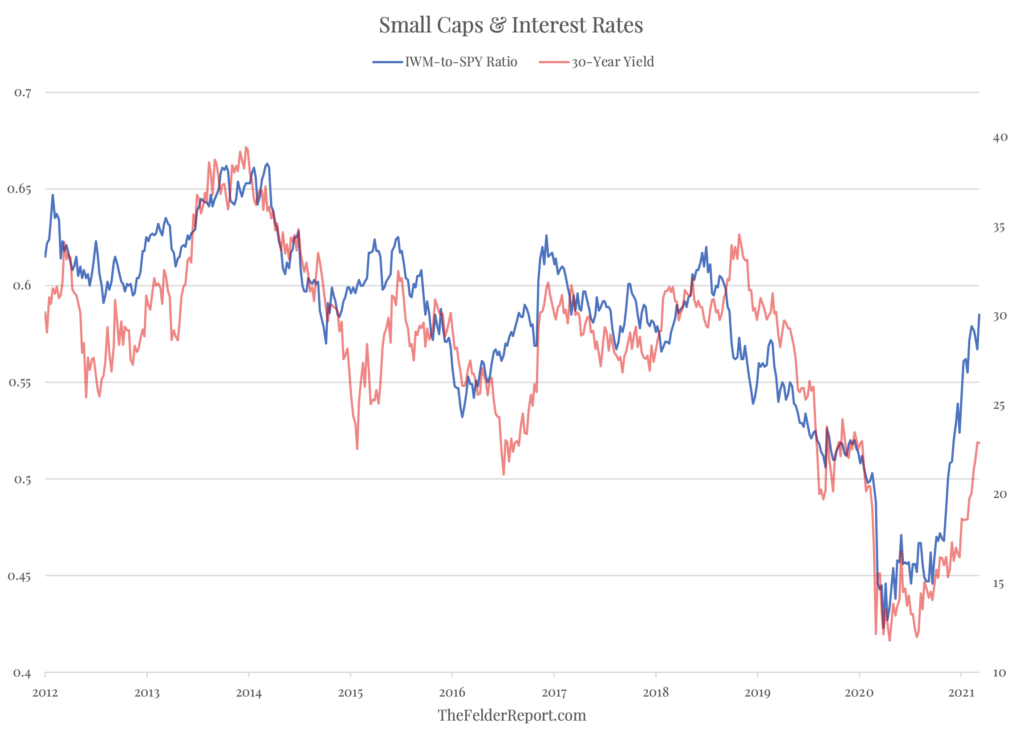

Finally, one of the key drivers of small cap outperformance, the rapid rise in long-term interest rates, may have run its course for now. Either way, the relative strength of small cap stocks of late may have already run further than can be justified by the current level of rates. The 30-year yield would have to reach 3% to confirm. If it doesn’t, there could be a quick give back of gains for small caps in the short term.

Longer-term, for valuations to return to any semblance of historical normalcy it would require a decline of about 80% in the Russell 2000 Index. Considering technical indicators are lining up in favor of a reversal, it would appear that investors here are now staring down what may be the most dangerous setup in the history of the index. And for more intrepid traders, this looks like a decent target for taking a shot at the dark side.